While Medicare covers the majority of your retirement health care expenses, you likely won't be able to use it to pay for everything. And those out-of-pocket charges could add up quickly.

One of the insurance add-ons that people most commonly turn to for financial peace of mind is Medicare Supplement insurance, which is also known as Medigap. But what is Medicare Supplement insurance, and how can you figure out if it's a good fit for your unique retirement needs and goals?

This guide will address some of the most frequently asked questions about Medigap insurance so you can make the right choice.

What Is Medicare Supplement Insurance?

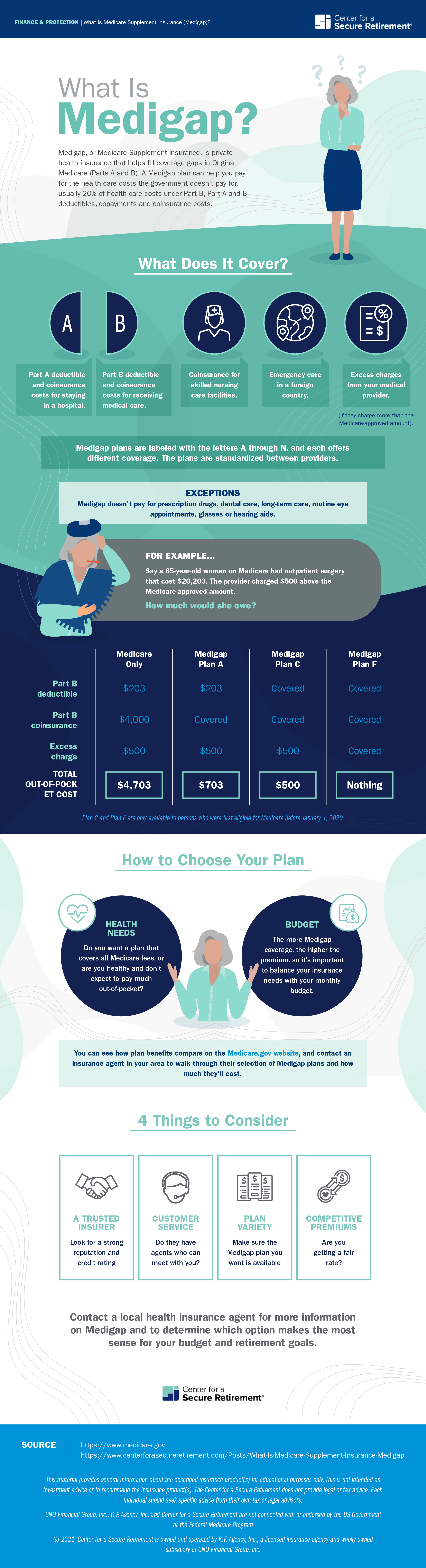

Medicare Supplement insurance is a type of private health insurance that's designed to work with the traditional Medicare program. It helps cover the deductibles, copayments and coinsurance costs that the government doesn't pay for.

Original Medicare — another term for Medicare Parts A and B — typically only covers 80% of health care services, and the remaining 20% is your responsibility. For example, if a surgery costs $10,000, Medicare would pay $8,000 and the provider would bill you for the remaining $2,000.

A Medigap plan can help you pay for these remaining costs. You pay a monthly premium and, in exchange, a private insurance company pays for your out-of-pocket expenses based on the policy terms. This can make it easier to budget for most situations and help reduce the chance that you'll have to worry about large bills when you need health care.

Who Is Eligible for Medigap?

To sign up for a Medigap plan, you must first be enrolled in Original Medicare. Some plans are only available for those who are at least 65 years old, while others are available to people who qualify for Medicare at a younger age, depending on the insurance company.

The best time to purchase Medigap insurance is when you first enroll in Medicare. Under federal law, you have a six-month open enrollment period that begins the month you are 65 or older and enrolled in Medicare Part B. During this time, you can sign up for any Medicare Supplement plan in your area and you are guaranteed to qualify. Insurers can't deny you based on your health or preexisting conditions.

After your open enrollment period, you can still apply for Medigap insurance, but you're not guaranteed to qualify. At this point, insurance companies can review your medical history and increase your premiums because of preexisting health conditions or even reject your application altogether. If possible, use your open enrollment period to find the plan that best fits your needs.

What Services Are Covered Under Medigap Insurance?

The Medicare website lists the out-of-pocket costs that aren't covered under Original Medicare, and you can see that they can add up. A Medigap policy can help pay for these costs, including:

- The Part A deductible.

- The Part A coinsurance costs for staying in a hospital.

- The Part B coinsurance payment for seeing a doctor or receiving medical care.

- The Part B deductible.

- The coinsurance for skilled nursing care facilities.

- The cost of care in a foreign country.

- Excess charges from your medical provider (if they charge more than the Medicare-approved amount, you would have to make up the difference).

While this list is typically accurate, what is actually covered by your Medigap plan depends on the type you purchase.

What Are the Different Versions of Medigap Insurance?

Medigap insurance plans are labeled with the letters A through N, and each has different coverage policies. For example, a Plan F will pay for excess charges from a medical provider, but a Plan A will not. You can see how the benefits compare on the Medicare.gov website.

To make it easier for consumers to compare their options, the government requires insurers to offer the same coverage for each version. In other words, a Plan A will include the exact same set of benefits regardless of which insurance company you buy it from. Insurance companies can charge different premiums for their Medicare Supplement insurance plans, but they can't change the benefits.

What Services Aren't Covered?

There are some health care expenses that Medigap insurance does not cover. For instance, these plans don't pay for the cost of prescription drugs. If you require prescription drug coverage, you would need to also purchase a Medicare Part D plan to go with your Medigap policy.

These plans also don't pay for dental care, routine eye appointments, glasses or hearing aids. In addition, Medigap plans don't cover long-term care, such as a stay in a nursing home or home-based care.

How Does Medigap Insurance Compare to Other Medicare Insurance Plans?

When making a choice about your supplemental health insurance, it's important to know the additional options out there. In addition to Medigap insurance, you can also cover health care expenses with a Medicare Advantage plan, also known as Medicare Part C. Even though both programs are for Medicare members, there are some significant differences.

While Medigap plans work alongside the standard Medicare program, Medicare Advantage is a private insurance replacement, meaning you leave Medicare and a private insurer covers your health care bills. The government gives the insurance company money and standardizes the program to make sure it's comparable to Original Medicare.

Insurers have a bit more flexibility with what they can offer with Medicare Advantage, so you'll see plans cover extra benefits like gym memberships, dentist visits, glasses and prescription drugs.

On the other hand, Medigap plans are more consistent because you can keep your plan for as long as you keep up with the premiums. With Medicare Advantage, your plan only lasts for a year. Each year, you'll need to renew, and it's possible your insurer might end your coverage. While this annual enrollment period is a chance to potentially find a better option, it can also be an extra hassle. With Medigap insurance, you don't have to make these changes.

How Do You Apply for Medigap Insurance?

If you decide that Medigap insurance is right for you, you can apply as soon as you join Medicare and sign up for Medicare Part B. Some people will be automatically enrolled in both Parts A and B when joining Medicare, while others will only be automatically enrolled in Part A, meaning they'll need to sign up for Part B separately before applying for Medigap insurance.

To get started, you need to find an insurance company selling plans in your state. Some ways to find insurers include using the Medicare website, calling your state's insurance commissioner's office, asking friends and family members for referrals and looking at local ads to see who's selling insurance in your area.

From there, you should contact the insurance company to set up an appointment with one of their agents. They'll show you their selection of Medigap insurance plans and how much they'll cost. The agent can help you determine which of the options makes the most sense based on your budget and retirement goals.

You can then apply for the plan you like best. If you apply during your Medicare open enrollment period, you're guaranteed to qualify. However, if it's past open enrollment, the agent could ask you questions about your health for the application.

Comparing all your Medigap options can feel overwhelming, but a trained insurance agent can support you throughout the process. With a bit of assistance and financial savvy, you can get your coverage in place and rest easy knowing you're protected from out-of-pocket Medicare costs.

David Rodeck

David Rodeck