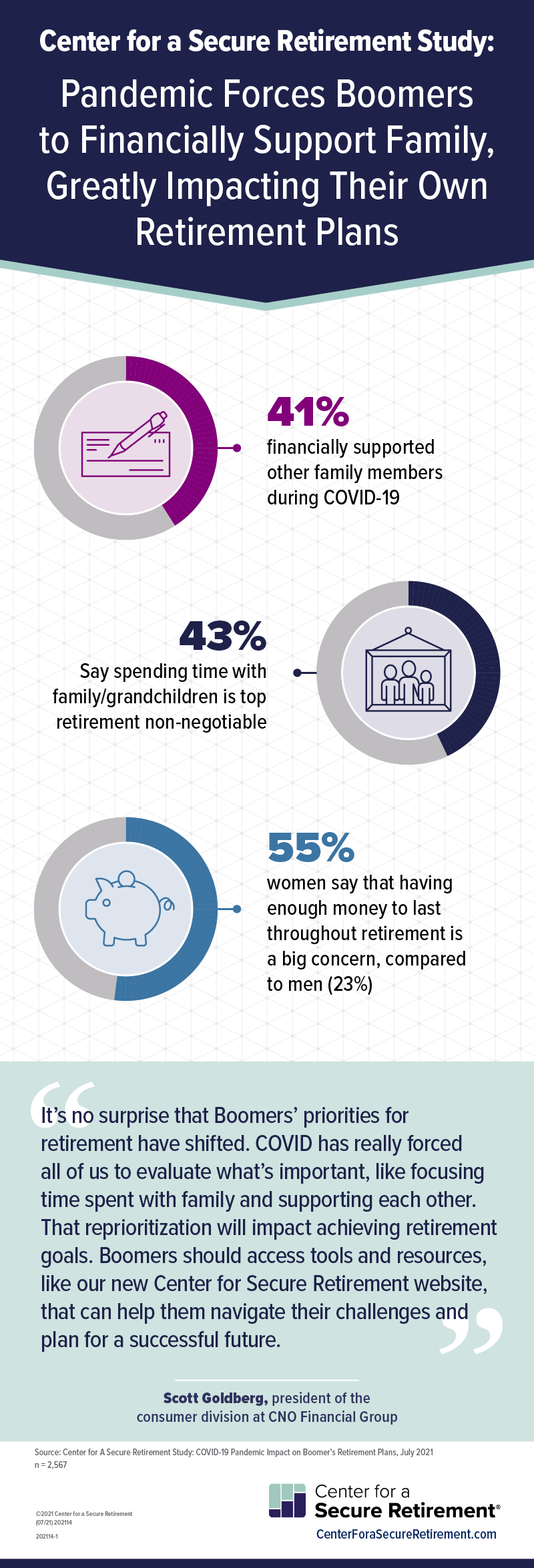

The COVID-19 pandemic has shifted the plans of many Americans, especially when it comes to financing and planning for retirement, according to the latest study from the Center for a Secure Retirement® and CNO Financial Group.

Survey results indicate that Boomers opened their homes and wallets to family during the pandemic, greatly impacting their own retirement plans. Of those boomers who had to financially support loved ones, many delayed their retirement, were not able to save as much, and/or delayed moving with over half expressing concern that they’ll never be able to retire.1

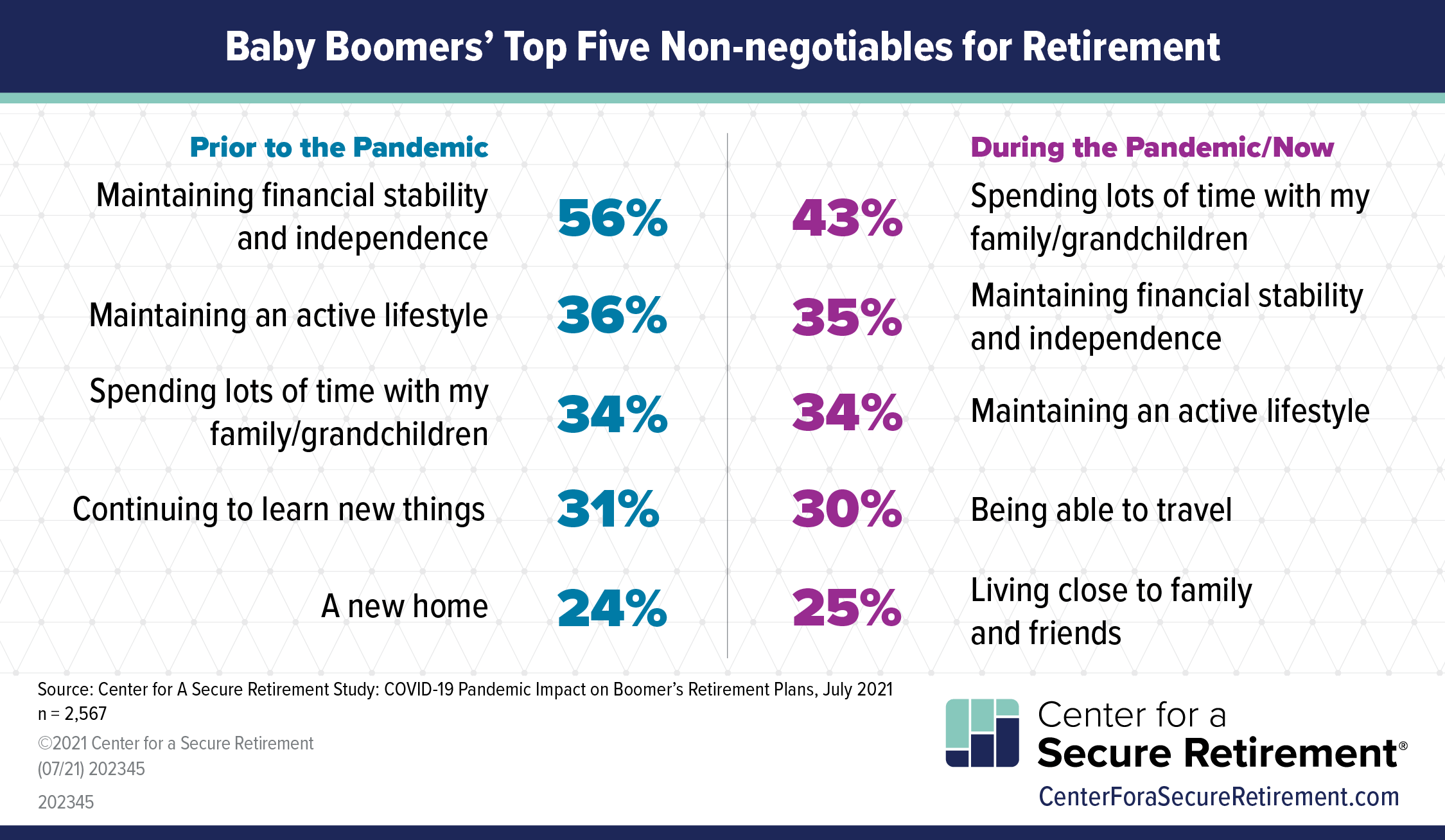

Interestingly, the pandemic has brought about a shift of priorities with more than half of the Boomers who previously placed financial stability for retirement as a top non-negotiable pre-pandemic, dropped to more than one-third not feeling the same way now. Not surprisingly, the study showed a new top priority was spending more time with family and grandchildren.

Impact of supporting family membersThe pandemic has put four in ten (41%) middle-income Boomers into the position of financially supporting other family members, which has impacted their own retirement plans, including:

- Have not been able to save as much – 75%

- Delaying moving – 65%

- Reevaluated finances and expenses for retirement – 51%

New retirement non-negotiables

Prior to the pandemic, more than half (56%) of middle-income Boomers reported that their top non-negotiable for retirement was maintaining financial stability and independence. This has now dropped to approximately one-third (35%). Boomers' top retirement non-negotiables now include:

- Spending lots of time with my family/grandchildren – 43%

- Maintaining financial stability and independence – 35%

- Maintaining an active lifestyle – 34%

- Being able to travel – 30%

- Living close to family and friends – 25%

Recommendations for Boomers to Get Back on Track

Despite some of the positives that have come out of the pandemic like prioritizing relationships and spending more time with family, it’s important that Boomers do not lose sight of their retirement plans even if that means tweaking things a bit. Of those who were not-retired, 52% say they had to reevaluate their retirement plans because of the COVID-19 pandemic with more than twice as many women (55%) as men (23%) saying that having enough money to last throughout their retirement was a big concern. Boomers can access a wealth of lifestyle, financial and health resources on the Center for a Secure Retirement site along with tools and resources to help navigate their path as they move out of pandemic life and get their financial plans back on track.

Methodology

The internet-based survey was conducted in April 2021 by OnePoll on behalf of the Center for a Secure Retirement. The survey consisted of a nationwide sample of 2,567 middle-income Americans age 57 to 75. For the purposes of this study, the Center for a Secure Retirement used the following definitions:

- What is middle income? Middle-income Americans have an annual household income between $30,000 and $100,000 and have less than $1 million in investable assets.

- Who is a Boomer? Boomers are Americans born between 1946 and 1964. They are 57 to 75 years old in 2021.

1 Of those who indicated they were not retired.

Downloadable Infographics

CSR Research

CSR Research