Life insurance can help you financially protect your loved ones and leave a legacy. Deciding where the proceeds from your policy will go by naming a life insurance beneficiary is an important part of setting up your plan.

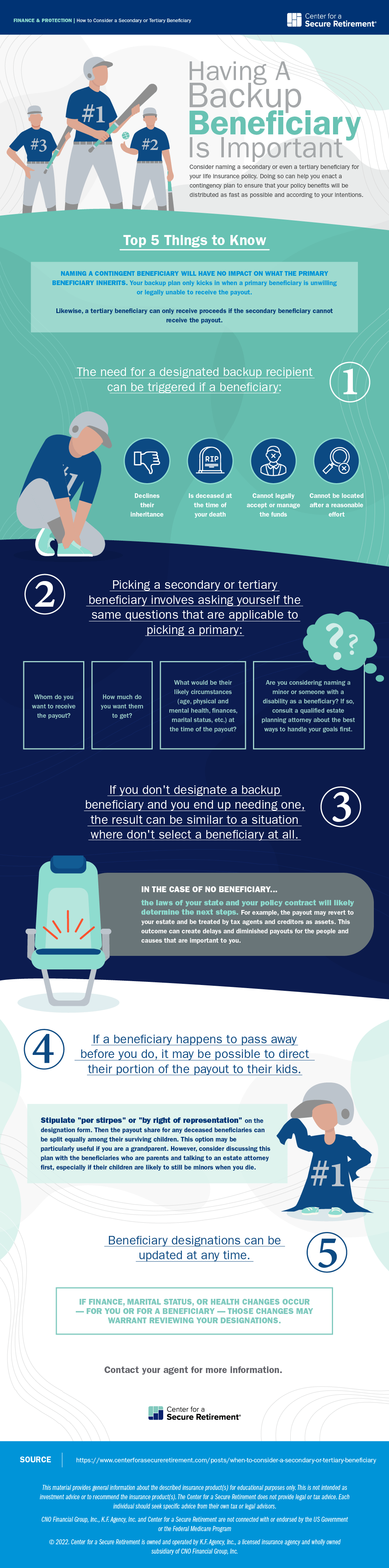

On top of naming a primary beneficiary, you may want to consider adding contingent beneficiaries who would receive the death benefit in the event that the primary beneficiary is unable to do so. You can name a secondary beneficiary, and in some circumstances you may want to select a tertiary beneficiary to ensure that your intentions for the money you leave behind are carried out.

What Is a Life Insurance Beneficiary?

When you set up a new policy, you will likely be required to name a primary beneficiary. People typically name someone who would need the death benefit to mitigate the financial impact of the policyholder's absence or someone who will be entrusted with taking care of the financial obligations that the policyholder will leave behind. A beneficiary might be a spouse, a child or someone who will manage assets from the policyholder's estate, such as a house with a mortgage. Organizations such as charities, alma maters or houses of worship can also be designated as beneficiaries.

Your policy will require information about your beneficiaries, such as their full names, Social Security or tax ID numbers and dates of birth. The primary beneficiary will be the person or entity who will receive the death benefit from your policy if you die. You can change beneficiaries at any time, and no one can decide for you who your beneficiaries should be or the order in which they will inherit their portions of the benefit.

Why Choose a Secondary or Tertiary Beneficiary?

When you set up your policy, you may want to have a back-up plan in case a primary beneficiary is unable to accept the inheritance you leave them. This can occur if a beneficiary:

- Declines the inheritance.

- Is deceased at the time of the policyholder's death.

- Is not legally able to accept the funds.

- Cannot be located after reasonable effort.

The back-up for your primary beneficiary is called a secondary beneficiary, and the back-up for your secondary beneficiary is called a tertiary beneficiary. Naming a secondary or tertiary beneficiary will have no impact on what the primary beneficiary inherits, but it can help ensure that the death benefit of your policy goes to someone you choose.

Alternatives to Consider

The process of dispersing life insurance proceeds as planned can be complicated by several factors. For example, there might be tax issues regarding your estate or other debt concerns that make it difficult for someone to inherit what you intended. Or the law might dictate that money from a policy cannot be released directly to a beneficiary and must go to a conservator or guardian instead.

Selecting a secondary or tertiary beneficiary is not the only way to help ensure that loved ones or worthy causes receive what you plan to leave behind, nor is it always the most ideal way. Some people navigate these issues by naming their estate, a living trust or an irrevocable life insurance trust (ILIT) as a primary beneficiary and leaving instructions in a will or trust document.

Having a trust as your life insurance beneficiary can make estate tax issues less of an obstacle to dispersing the full value of your policy proceeds to heirs. If the documentation is properly set up with legal and financial professionals, it can dictate the order of inheritance (primary, secondary, tertiary, etc.) and ensure that the funds are dispersed according to this order and any other requirements you specify.

Keeping Your Beneficiaries Current

Regardless of how you choose to name beneficiaries and set up your affairs, keep your policy paperwork up to date. Your insurance company will follow the line of contingency by not dispersing funds to heirs unless other named beneficiaries with prior standing are unable to accept the money. If you find that a beneficiary is no longer a viable candidate to receive your policy proceeds, you can work with your provider to adjust your beneficiaries list accordingly.

Tasha Williams

Tasha Williams