If you're worried about the high out-of-pocket costs from Medicare, one possible solution is to join a Medicare Advantage plan. These health insurance plans offer similar and usually even more coverage than standard Medicare. However, they also have some downsides depending on which you pick.

Here, we'll cover what is a Medicare Advantage plan so you can decide whether one might make sense for you.

What Is a Medicare Advantage Plan?

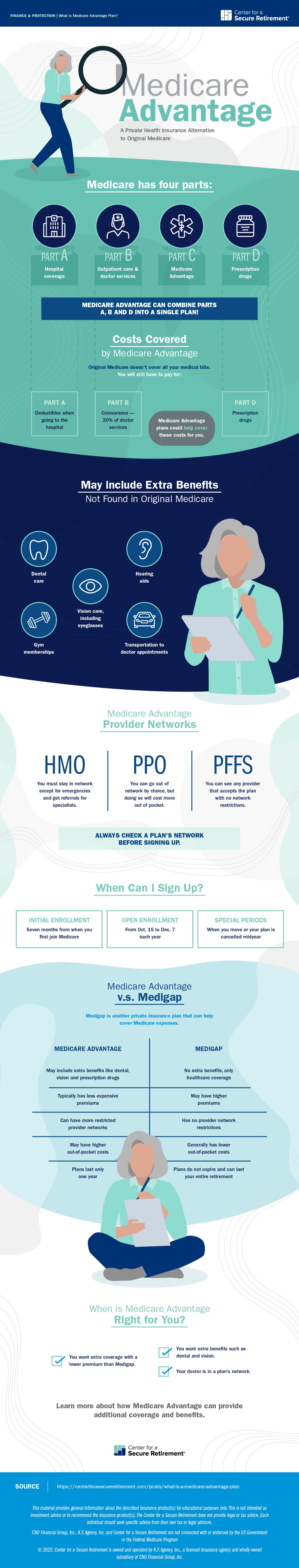

Medicare Advantage is a private insurance program also known as Medicare Part C. You must be enrolled in Medicare Part A and Part B to join one of these plans. When you sign up, you leave Medicare, and an insurance company handles your medical bills instead, using money from the government. The government does regulate Medicare Advantage plans, so they must offer benefits similar to what you'd receive from Medicare.

Insurance companies could charge you a monthly premium and, in exchange, offer even more healthcare coverage than Medicare. Some plans also include prescription drug coverage, so you wouldn't have to buy a separate drug plan.

Medicare Advantage plans can include extra benefits, too, like dental and vision care, eyeglasses, transportation to doctor's appointments and even gym memberships. These plans may offer some basic benefits for long-term care, like payments for adult day care, but are not as comprehensive for nursing homes, assisted living or at-home nursing care as a standalone long-term care insurance policy.

How Does Medicare Advantage Compare to Traditional Medicare?

If you only have Medicare, you could be responsible for some sizable out-of-pocket expenses for needing medical care. For example, Medicare Part A charges a $1,484 deductible when you go to a hospital.

A Medicare Advantage plan could have significantly lower out-of-pocket expenses than regular Medicare. It depends on the program. Some plans charge low premiums or are even free, but in exchange, the out-of-pocket fees may be higher. Others charge much lower out-of-pocket fees than Medicare, though you could pay a higher monthly premium.

Another key difference is the provider network. Medicare uses an open network, which allows you to go to nearly any doctor, hospital or other medical provider so long as they accept Medicare (which most do). Some Medicare Advantage plans follow the same approach, but others are more restrictive, depending on the plan type.

What Types of Medicare Part C Plans Are Available?

- Health Maintenance Organization (HMO): In an HMO, you can only go to providers and hospitals in the plan network, unless it's an emergency. To see specialists, you may also need a referral from your primary care doctor.

- Preferred Provider Organization (PPO): In a PPO, you can see out-of-network providers, but it will cost you more out-of-pocket than if you saw an in-network provider.

- Private Fee-for-Service (PFFS): With these plans, you can see any doctor, hospital or medical provider that accepts the plan terms. This is the same system as regular Medicare.

- Special Needs Plans (SNP): These plans are geared toward people in specific situations, like those on Medicaid and Medicare or those with chronic medical conditions.

- HMO Point-of-Service (HMOPOS): Similar to PPOs, these plans let you see out-of-network providers for a higher out-of-pocket cost. You may need a referral from your primary care physician for some services, depending on the insurance company.

- Medical Savings Account (MSA): In an MSA, you join a health insurance plan with a higher deductible. Medicare will then deposit money into your bank account, which you can use during the year for your health care expenses.

A general rule of thumb is that plans with more restricted networks are usually more affordable.

How Do You Sign Up for Medicare Advantage?

There is no medical underwriting for Medicare Advantage, so you can join even if you have preexisting conditions. However, there are limits on when you can sign up.

Initial Enrollment

When you first qualify for Medicare — usually when you turn 65 — you're granted an Initial Enrollment period of seven months. It lasts the first three months before you turn 65, the month you turn 65, and then the following three months. During this time, you can sign up for any Medicare Advantage plan in your area.

Other Enrollment Periods

After Initial Enrollment, you can only join at certain points during the year. There is an Open Enrollment period that runs from October 15 to December 7, during which you can sign up for any plan in your area to start coverage on January 1 the following year. If you change your mind, you can still switch plans within this period.

From January 1 to March 31, if you're part of a Medicare Advantage plan, you can make one last substitution, either moving to a different plan or reverting to Original Medicare. There are also special situations in which you can change or join plans outside of the normal times, like if you move to a new area or if Medicare cancels your plan.

Annual Renewals

Medicare Advantage plans only last one year. Your insurance company could keep your plan the same for the following year, but it's also possible they'll make significant changes to the benefits and costs. Each year, you'll need to review your coverage and may have to switch plans during Open Enrollment.

How Does Medicare Advantage Compare to Medigap?

Another way to handle your retirement health care costs is through a Medicare Supplement plan. This type of plan is also called Medigap because it pays for the coverage gaps in Medicare. Rather than creating a separate private insurance program, Medigap plans partner with Traditional Medicare. The government pays most of your bills, while the insurance company just covers the out-of-pocket expenses.

These plans are labeled by a letter, from A through N, and each has its own benefits. For example, Plan F covers emergency care while traveling abroad, whereas Plan A does not. Medigap plans are standardized, meaning insurers do not have the flexibility to change the benefits like they do with Medicare Advantage.

Medigap Plan C offers the same coverage at every company, though the premiums could be different. It also doesn't allow insurers to customize these plans with extra benefits, like prescription drugs, dental care or eyeglasses. Additionally, Medigap plans can be more expensive.

On the other hand, these plans won't change your benefits over time, and you won't have to renew after you sign up. Also, since Medigap plans partner with the Medicare program, they can offer a wider provider network than Medicare Advantage, especially HMOs or PPOs.

Is a Medicare Advantage Plan Right for You?

A key part of answering this question is learning what plans are available in your area. Some areas will have several plans to choose from, while others are more limited. Medicare offers an online search tool for comparing local plans to see if one fits your needs.

Medicare Advantage plans may offer more coverage than regular Medicare, especially if you're paying an extra monthly premium. If you can afford it, that protection can help prevent surprise medical bills. Then, the decision is whether Medigap or Medicare Advantage makes more sense.

If you're in relatively good health, want the extra benefits (such as prescription drugs) and don't mind possibly having to switch plans each year, Medicare Part C could be a good fit. If you don't mind paying a bit more for premiums, aren't interested in the extra benefits and would prefer steadier coverage that doesn't change, Medigap could be better.

For more information on what is a Medicare Advantage plan, consider speaking with a health insurance agent to compare your options.

David Rodeck

David Rodeck